In this post, we focus on presenting a basic guide for the calculation of emissions in accordance with the CBAM regulation.

The Carbon Border Adjustment Mechanism (CBAM) regulation emphasizes the importance of reporting actual emission data for imported goods within its scope. This approach moves beyond the common practice of relying solely on default emission factors (EF), ensuring a more accurate reflection of the real emissions. Depending on the imported good, the associated emissions of different gases need to be considered. The total emissions need to be reported in the unit of measure CO2 equivalent, commonly noted as CO2e.

This approach presents new challenges for companies, which must report verifiable data based on proven calculation methods. Therefore, in this section, we provide guidance with a calculation example. We present a detailed process for calculating the embedded emissions for a given quantity of a selected good under the scope of CBAM.

But first, it is important to note that the regulation classifies the goods under its scope as ´simple´ or ´complex´. It states a good as ´simple´ when that good is produced in a production process requiring only input materials and fuels that are themselves not under the scope of CBAM, therefore not being considered as having embedded emissions. On the other hand, ´complex´ goods are those under the scope of the regulation that for their production a ´precursor´ good targeted by CBAM is used. In our example, we cover the case for the calculation of emissions associated with a ´simple´ good.

In the case of complex goods, you can follow the same calculation steps as in the case of a simple good. However, the difference is that you must add to the total result the emissions embedded in the quantities of the precursor simple CBAM goods that have been used for its production. Therefore, and just for the case of ´complex´ goods, it is permitted to justify up to a maximum of 20% of the total emissions using EF, provided that those EF are recognized by the European Commission (EC).

As the regulation requires reporting both direct and indirect emissions of the production process, electricity consumption is incorporated into the calculation.

Example: CO2e calculation for a ´simple´ good under CBAM

*All values in the calculation are exemplary only! To not be re-used in real reporting use cases.

In this example, we consider a scenario where a company imports sintered iron ore into the EU, a product that falls under the scope of the CBAM. As an importer, the company requires reporting the emissions associated with the production of this product. We will outline the steps required to be to calculate these embedded emissions expressed in terms of CO2e.

The classification and trade codes for goods covered by the regulation can be found in the Annex I of the EU CBAM Implementing Regulation. The product “sintered iron ore” is classified under the Combined Nomenclature (CN) with the following code:

This code is included in the scope of CBAM, under the list of products of “Iron and Steel”. For SAP users, the CN code of the goods should be documented in S4/HANA (Fiori -> Customs Management).

For this example, we will consider that the country of origin for the product is India, which has several sintering plants in its territory.

In this step, it is important to identify the relevant operations and flows involved in the production of the good, as well as emissions sources that must be included according to the regulation

The sintering process of iron ore involves fusion of fine particles of iron ore to form larger “aggregates”, through high-temperature melting. During this process, fine iron ore particles are mixed with limestone and water to facilitate aggregation, while fine coke is added as a fuel source. Additionally, electricity is required to operate the equipment. The amount of each input used depends on its quality, composition, and the technology used. Image 1 (below) provides a flow diagram to help visualize this process. For this calculation example, a generic composition and proportion of inputs will be considered (% w/w presented in Image 1).

The first task is to ensure that the targeted product is classified as a ‘simple’ good under CBAM. This involves checking its precursors. In this case, the precursor iron-containing material, classified under the CN code 26 01 11 00, code which is not under scope of CBAM. Therefore, it can be confirmed that this process represents the production of a ‘simple’ CBAM good.

As a second task, it is necessary to determine which greenhouse gases need to be reported and included in the calculation for this product. To do so, Annex I of the regulation must be reviewed. According to the regulation, for products classified under the CN code 26 01 12 00, only carbon dioxide needs to be considered.

The next and third task is to review the CBAM Implementation Regulation, which provides information on the flows that must be considered when calculating direct emissions for a particular “production route”, which is how the regulation refers to alternative production processes. For this, it is important to check Table 1 in Annex II of the Regulation to identify the aggregated goods category under which the target product falls. In the case of the product ‘sintered iron ore’, it is classified under the aggregated goods category “Sintered Ore”. Then, chapter 3 of the same Annex II provides guidance on the key flows to analyze for the selected aggregated goods category (in this case “Sintered Ore”). According to the regulation, for sintered iron ore, the direct emissions calculation must at least consider:

For simplification, this example assumes that no precursors contain carbonates, and that no flue gas cleaning is conducted as part of the production process. As a result, the boundaries for calculating the direct emissions in this example include: the CO2 emitted from burning the solid fuel (fine coke in this case) and the CO2 generated because of the limestone calcination reaction.

Finally, as one last task in this step, it is necessary to review whether the process consumes electricity, as this is a source of indirect emissions for the regulation. To produce sintered ore, electricity is required to operate the equipment. Therefore, the carbon emissions associated with the production of the consumed electricity must also be included in the calculation and reported.

The Regulation mandates importers to report emissions using primary data obtained from activity or emissions monitoring at the supplier’s production installations. Only in specific, clearly justified cases, does the regulation allow importers to use secondary data from reliable sources. In this example, which is a hypothetical scenario for guidance purposes, default emissions factors are sourced from internationally trusted secondary data to calculate the process emissions.

Direct Emissions

Based on the step 2, we need to calculate the direct emissions generated from two chemical reactions:

a. Limestone calcination

b. Coke burning

Let’s start with (a):

The chemical reaction of the burning of the different limestone components are as following:

Based on Image 1, the quantity of limestone used for the production of 1 ton sintered ore is:

1.000 kg x 0.15/(0.5+0.22+0.15) = 172.5 kg.

For this example, the composition of the limestone is 90% CaCO3 and 10% CaMg(CO3)2, therefore:

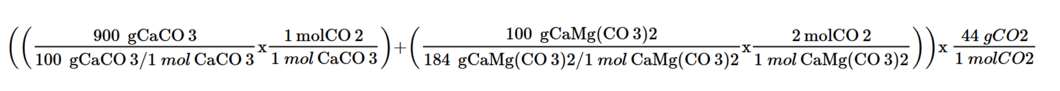

1 kg limestone in example is composed of 900 g CaCO3 + 100 g CaMg(CO3)2

Thus, the calcination of 1 kg of limestone leads to:

= 420 gCO2 = 0.42 kg CO2

= 420 gCO2 = 0.42 kg CO2

For the total emissions from Limestone, we obtain:

Now, let’s focus on (b):

For the coke emissions when burning, we guide ourselves by the default factor informed in Annex VIII of the implementation regulation. In this Annex VIII it is stated that the emission factor for coke oven coke and lignite coke is 0.107 kgCO2/MJ, and that the net calorific value of this fuel is 28.2 MJ/kg.

Based on the data given in Image 1, in this example the quantity of coke burned for obtaining 1 ton of sintered ore is:

=1.000 kg x0.05/(0.5+0.22+0.15) = 57.5 kg

Then, we can obtain the total emissions from Coke:

Burned Coke Quantity (kg) x Emissions of CO2e/kg Coke

= 57.5 kgCoke x 0.107 kgCO2/MJ x 28.2 MJ/kg Coke

= 173.5 kgCO2

Indirect Emissions

In this case, the indirect emissions are related to the production of the consumed electricity. As the plant is located in India, it is necessary to use a local emission factor. According to IEA, the emission factor for electricity in India can be considered today as 0.853 CO2e/kWh.

For the plant energy consumption, we will consider the values reported for an average plant of sintering ore manufacturing: 1.8 kWh/kg production.

Now we calculate the total emissions from electricity consumption:

Total Emissions

For the total emissions, we sum the direct and the indirect emissions:

= 72.45 + 173.5 + 1535.4 = 1,781.35 kg CO2e ~-> 1.78 metric tons of CO2e.

Therefore, for this example, the total emissions (as CO2e) for producing one ton of sintered ore according the CBAM regulation are 1.78 tons.

Under CBAM, EU importers are required from January 2026 onwards:

The carbon price will change on a weekly basis, based on the average price of EU ETS allowances (€/ton of CO2e) observed during the previous week.

But importers can obtain a discount if they prove that there has been already a Carbon price paid in the country of production. The quantity to be discounted will be proportional to the carbon value that has been paid abroad. This we cover in our next step (7).

This step accounts for any carbon costs that have already been paid in the country of origin (in the case of our example, in India) under a local carbon pricing mechanism or carbon tax. The idea is to ensure that there is no double taxation or undue burden on the importer under the EU Carbon Border Adjustment Mechanism (CBAM).

Why Adjust for Carbon Costs Paid Abroad?

Calculation of carbon emissions for complex goods – definition and high-level steps

According to the Guidance Document on CBAM Implementation for importers of goods into the EU “means goods other than simple goods”. They are defined as products that consist of multiple components and often undergo various stages of processing. The mechanism primarily focuses on specific sectors and goods that are energy-intensive and have a high carbon footprint. A well-known example of a complex good is cement, as they include the embedded emissions from precursor goods.

In the case of complex goods, the calculation steps follow the same approach as for the complex goods. But with the inclusion of the emissions to produce the precursors and indirect emissions from purchased electricity for their production as well. An example of complex goods is iron ore pellets produced from iron ore concentrates, additives, and other bonding chemicals.

At BearingPoint, we specialize in navigating the complexities of CBAM and other procurement and supply chain regulations. Our dedicated team is here to ensure your business not only meets compliance standards, but thrives in this evolving landscape.

Empowerment through understanding: We provide comprehensive training and transformational support, guiding you through every stage of CBAM compliance. Our goal is to equip your team with the essential knowledge and tools for enduring success.

Strategic Supplier Enablement: We help you define strategies and methods to enhance communication and collaboration with your suppliers, ensuring accurate gathering and verification of emission data to meet regulatory requirements.

Accurate CBAM calculation: Our expertise enables you to conduct precise emission calculations, enhancing your operational efficiency and equipping you with the necessary processes and tools for compliance.

Efficient reporting and verification: We assist you in preparing and submitting all required documentation for CBAM compliance, while establishing robust internal processes for verification and accountability.

By leveraging our deep knowledge and experience, we help your team grow, minimize risks and optimize reporting processes, thus ensuring CBAM compliance and making your processes more robust in the sustainability dimension

Want more information? Contact us!