Process start

First, all relevant contract data is automatically transferred from the master data and inserted into the contract template.

The digital, end-to-end contract process allows insurance companies to efficiently and transparently handle compensation and brokerage agreements without media discontinuity.

Automated data mapping, validation logic, and eIDAS-compliant signatures significantly reduce administrative effort and sources of error. Broker managers and brokers benefit from an improved user experience, fewer queries, and faster processing. Automated creation and storage of contracts in inventory systems ensures consistency and traceability. Changes and corrections can be made flexibly and digitally without restarting the process. This shortens closing times and increases sales productivity sustainably.

Get a free live demoProcess start

First, all relevant contract data is automatically transferred from the master data and inserted into the contract template.

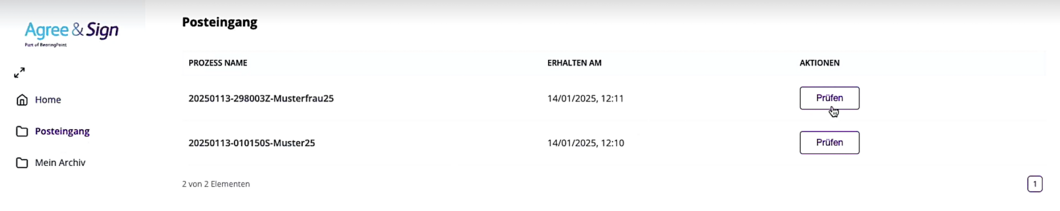

Approval

An advisor digitally checks the contract data and releases it for further processing. If necessary, corrections can be made directly in the system.

Option for error correction

Brokers or account managers can correct specific errors, updating only the affected fields.

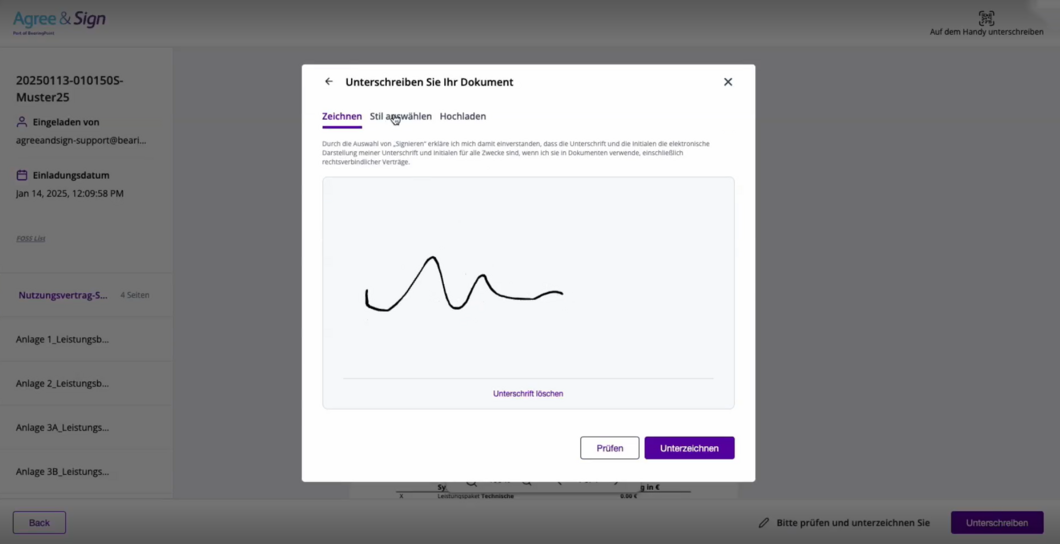

Digital signature(s)

Contract documents are signed digitally and in accordance with eIDAS by authorized signatories directly within the process, ensuring the entire process remains legally compliant and paperless.

Contract creation

After signing, the final, sealed documents are automatically created and transferred to connected systems without manual intervention.

Contract conclusion

The process concludes with the digital storage of all contracts and documents in the inventory system. This gives all parties involved access to the current agreements at all times and significantly reduces conclusion times.