The Value of AI

The SAP & Oxford Economics Study and what it means for Leasing

The SAP & Oxford Economics Study and what it means for Leasing

The study was commissioned by SAP and conducted by Oxford Economics, an independent research services provider. It explores the current and near‑term business value of AI across eight global markets with a dedicated German sample. The research surveyed 1,600 senior executives (director level and above), from organizations in Australia, Brazil, China, Germany, India, Singapore, the UK, and the US, evenly split between mid‑market (500–1,500 employees) and enterprise (≥1,500 employees). The survey was fielded in July–August 2025 via an online quantitative instrument scripted and hosted by Oxford Economics.

AI is already embedded - and accelerating. Today, AI supports 25% of tasks in German businesses, and executives expect that figure to rise to 41% within two years. Most organizations report they are experimenting with or scaling AI automation and generative AI, with almost no respondents saying they have no plans to adopt these technologies. The adoption wave is strong: 53% of businesses say they are finding solutions despite hurdles and continue to progress, while just 1% believe AI will never become central to processes, decisions, and customer offerings. Implication: For leasing companies and captives, this means AI‑driven task support (e.g., customer query triage, asset valuation aids, fraud flags) will shift from pilot projects to everyday operations, raising expectations from boards and regulators for measurable outcomes and governance.

German companies report US$34.4m average annual AI spend in the current fiscal year and expect AI investment to increase by 37% over the next two years, alongside a 21% increase in data investment. Yet prioritization is largely non‑strategic: only 9% invest based on strategic, holistic prioritization, while 45% adopt piecemeal approaches and 33% rely on department‑led prioritization. Implication: Captives should move from opportunistic to portfolio‑managed AI, aligning use cases with enterprise value drivers (e.g., end‑to‑end origination, credit decisioning, collections) and establishing a central steering model to avoid duplicated tools and inconsistent controls.

ROI is real - and rising. The average ROI from AI in Germany is 17% (≈US$5.9m) today, with expectations to nearly double to 31% (≈US$15.3m) in two years. 77% of businesses believe AI investments achieve positive ROI within 1–3 years, and 39% agree AI initiatives deliver positive ROI faster than other technologies. Still, 68% are unsure or don’t agree AI is delivering its full potential. Implication: Leasing firms can realistically target short payback windows by focusing on use cases with clear cost‑to‑value mappings—for example, reducing manual touches in contract creation, accelerating credit checks via AI‑assisted document extraction, or cutting DSO through smart collections outreach.

Outcomes beyond efficiency. Contrary to the idea that AI’s value is mainly productivity, respondents identify innovation, customer engagement, speed of delivery, and time‑to‑value among the outcomes seeing significant improvement. In fact, 60% say AI has been effective in overcoming key business challenges. Implication: Beyond back‑office automation, captives can use AI to personalize offers (e.g., mileage‑based pricing for vehicle leases), speed up service responses, and introduce novel embedded finance experiences within OEM portals.

Data readiness: important but inconsistent. 77% of organizations say data is very important or critical in AI investment decisions, and two‑thirds (64%) rate their overall data readiness as sufficient. Yet legal/risk/compliance, finance, and HR are among the least data‑ready functions. The top data hurdles are incomplete/inconsistent data (77%), poor data quality (68%), and siloed data (74%). Furthermore, 58% lack confidence in responsibly sharing/integrating data across functions, and 67% lack confidence in sharing with external partners. Implication: Leasing businesses—especially captives—must resolve data harmonization across ERP, contract management, and asset repositories and establish partner‑grade data sharing standards to enable AI‑driven origination and lifecycle services at OEM scale.

People & guardrails: progress with gaps. Companies are integrating AI into the workforce via upskilling/reskilling (75%), augmenting roles, and redesigning jobs. Still, 70% say staff haven’t completed comprehensive AI training, and 65% agree that without guardrails, AI investment is very risky. Shadow AI is prevalent: 92% report staff use it to some degree; 67% say it happens at least occasionally; 84% are concerned about shadow‑AI risks; and more than half have experienced inaccurate outputs (54%), with notable instances of data leakage or exposure (34%) and security vulnerabilities (31%). Implication: Captives should implement approved AI workbenches, policy‑based access, prompt governance, and model risk management to reduce uncontrolled tool usage, particularly in regulated processes (credit, KYC, collections).

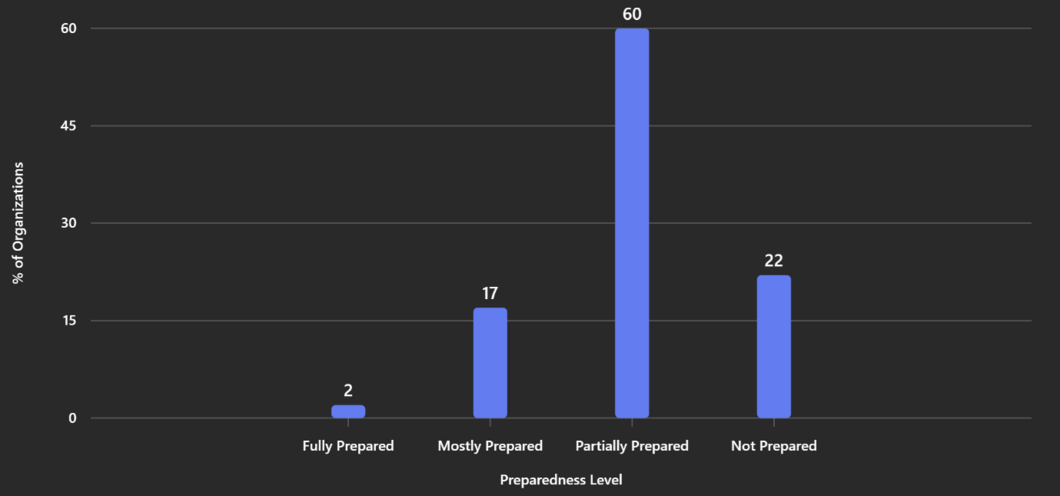

Agentic AI: the next phase. 72% see moderate to very high potential for agentic AI to transform operations, with top benefits in automating end‑to‑end processes, enhancing planning & decisions, and improving operational efficiency. 57% have piloted agent‑based use cases; 54% are upskilling/recruiting for adoption; yet only 2% feel fully prepared to deploy and scale agents (most are partially prepared (60%)). In Germany, organizations expect 10% ROI from agentic AI in the next two years; 46% foresee significant influence on strategic planning; 50% say there’s a clear, shared understanding of what agentic AI is. Implication: For leasing, autonomous process agents can orchestrate multi‑step workflows - e.g., checking asset availability, pre‑validating customer documents, triggering credit scoring, generating contract drafts, and scheduling delivery - while maintaining compliance trails.

What maximizes AI ROI. The top‑ranked levers are alignment with business strategy and availability/quality of data, followed by best‑of‑breed AI platforms, cross‑team collaboration, executive sponsorship, defined use cases, and skilled AI talent. Implication: Leasing leaders should anchor AI roadmaps to P&L outcomes (e.g., lower cost per contract, faster cycle time, higher renewal rates) and invest in data foundations that tie ERP, leasing contract management, and asset data into a semantically rich layer for trustworthy AI.

For movable goods leasing - such as cars, IT hardware, industrial equipment - AI offers tangible, near‑term value:

Because Lease&Rent - BearingPoint’s SAP BTP‑based Leasing Contract Management solution - operates on the SAP platform, SAP Joule can natively interact with enterprise processes and data across ERP, finance, and contract domains. In practice, Joule can (via governed access and business context):

These capabilities lead to immense efficiency gains (fewer manual touches, faster cycle times, lower error rates) and higher decision quality (consistent data, embedded guardrails). The age of AI has already started for the leasing industry, and the greatest value will accrue to companies running on holistic platforms - a state‑of‑the‑art ERP, a scalable contract management solution, and advanced asset management - so they can harness applications + data + AI in a reinforcing flywheel. In short: SAP S/4HANA with BearingPoint Lease&Rent is the entrance door to the world of AI for leasing.